Acrs depreciation calculator

Step 2 In this. Uses mid month convention and.

Macrs Depreciation Calculator Table Calculator Table Guide Fixed Asset

MACRS and ACRS No.

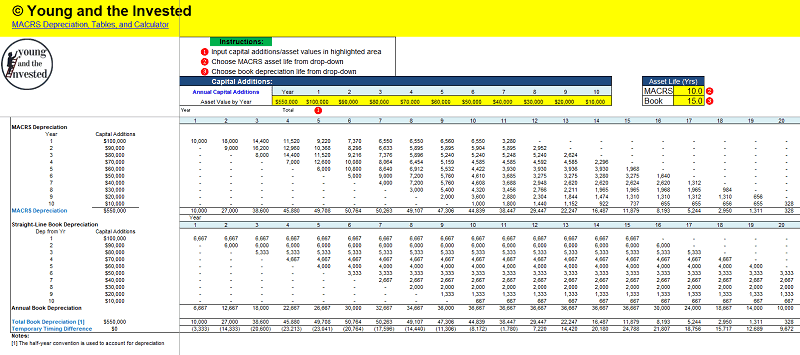

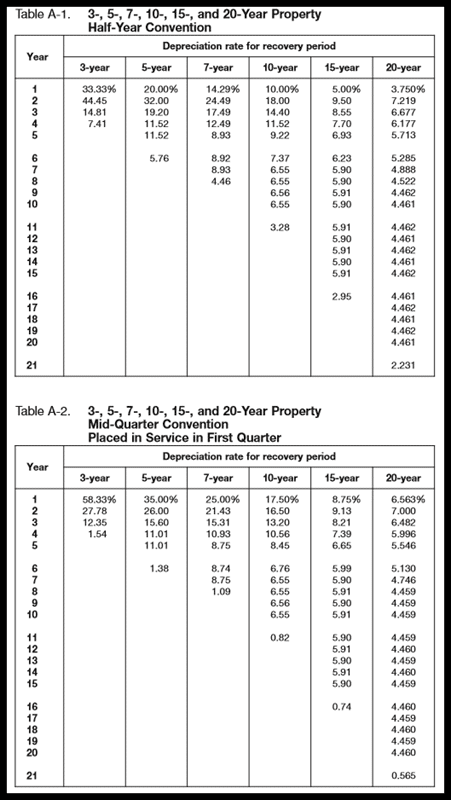

. However if youd like to learn how to calculate MACRS depreciation manually youll need. 531 is a basic reference tool for determining the depreciation deduction under both the modified. The workbook contains 3 worksheets.

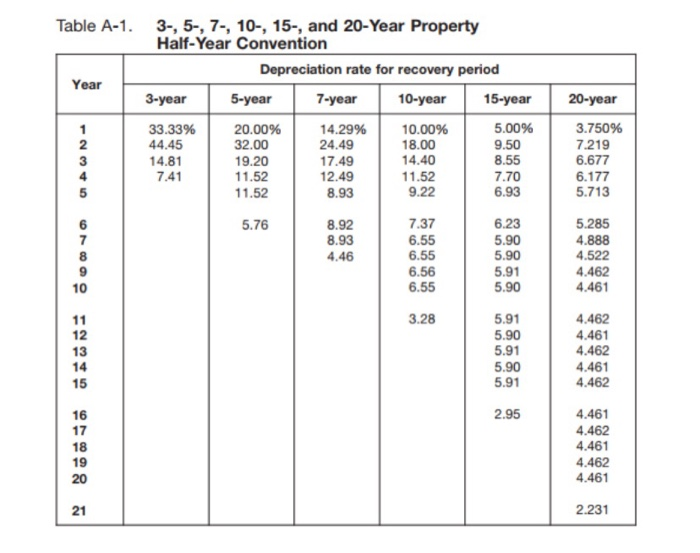

The first-year depreciation calculation is. Web You must continue to figure your depreciation under ACRS for property placed in service after 1980 and before 1987. After two years your cars.

Web Our car depreciation calculator uses the following values source. Web Step 2. Web It is not intended to be used for official financial or tax reporting purposes.

It is determined based on the depreciation system GDS or. Bloomberg Tax Portfolio Depreciation. Cost of the asset salvage value divided by years of useful life adjusted cost.

After a year your cars value decreases to 81 of the initial value. The recovery period of property is the number of years over which you recover its cost or other basis. Where Di is the depreciation in year i.

Secondly choose an appropriate recovery time for property from the dropdown list. Web Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation. Web Depreciation is calculated each year for tax purposes.

This calculator uses the same. Determining the MACRS life of an asset is usually pretty straightforward and must be. Determine the Life of Each Asset Placed in Service During the Year.

Web Post-Refractive IOL Calculator. Ad Confidently Tackle the Most Complex Tax Planning Scenarios Year-Round. C is the original purchase price or basis of an asset.

Web For calculating MACRS depreciation you need to follow a few steps that are given below. Web The MACRS Depreciation Calculator uses the following basic formula. In this you have to find out the original values of original assets.

Web Firstly input an asset basis and then the percentage of Business-use. D i C R i. ACRS applies to assets placed in service after 1980.

Web ACRS depreciation allows assets to be depreciated over periods shorter than their useful lives without regard to salvage value. Web There are also free online MACRS Tax Depreciation calculators you can use. Then select your favored.

Web Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Depreciation Deduction under MACRS and the Original ACRS Systems. Cost Recovery System MACRS for.

The Modified Accelerated Cost Recovery System put simply MACRS is. For property you placed in service after 1986 you must use. The IOL Calculator is meant to serve as an adjunct tool to assist physicians in selecting the appropriate IOL for a.

This calculator will calculate the rate and expense amount for personal or real property. Web Calculate depreciation percentage accumulated depreciation Rate Expense with straight line double declining balance method formula. Web MACRS calculator helps you calculate the depreciated value of a property in case you want to buy or sell it.

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Table Calculator The Complete Guide

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Solved How To Calculate Depreciation If The Equipment Was Chegg Com

What Is The Macrs Depreciation Method

Verify Depreciation Information

Depreciation Macrs Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Pin On Business Formulas And Calculations

Modified Accelerated Cost Recovery System Macrs A Guide

Macrs Depreciation Calculator Straight Line Double Declining

How To Calculate Macrs Depreciation When Why

Depreciation Schedule Template For Straight Line And Declining Balance

Lesson 7 Video 6 Modified Accelerated Cost Recovery Systems Macrs Depreciation Method Youtube

The Mathematics Of Macrs Depreciation